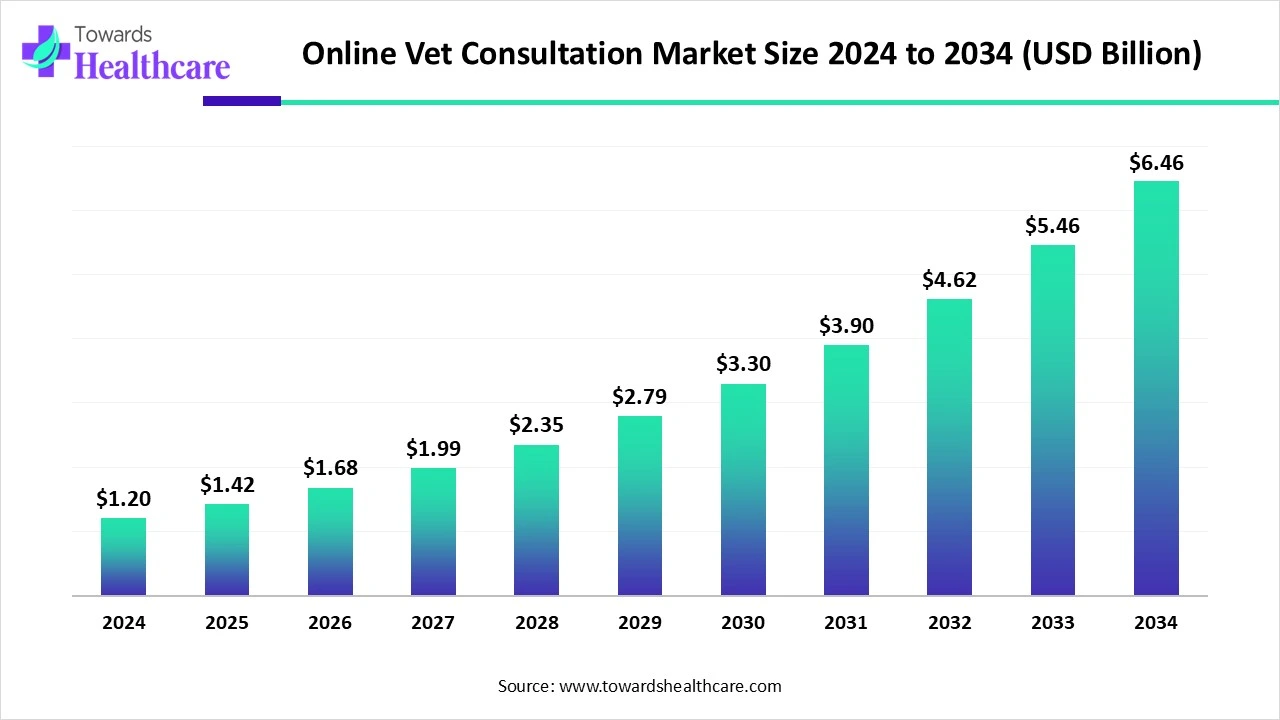

Online Vet Consultation Grows With Pet Owners’ Changing Needs, USD 6.46B by 2034

The global online vet consultation market size was valued at USD 1.42 billion in 2025 and is predicted to hit around USD 6.46 billion by 2034, rising at a 18.34% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

Ottawa, Feb. 10, 2026 (GLOBE NEWSWIRE) -- The global online vet consultation market size is calculated at USD xx billion in 2026 and is expected to reach around USD 6.46 billion by 2034, growing at a CAGR of 18.34% for the forecasted period.

Want a Closer Look? Download a customized sample of the Online Vet Consultation Market Report: https://www.towardshealthcare.com/download-sample/5624

Key Takeaways

- Online vet consultation industry poised to reach USD 1.2 billion in 2024.

- Forecasted to grow to USD 6.46 billion by 2034.

- Expected to maintain a CAGR of 18.34% in 2025.

- North America was dominant in the online vet consultation market in 2024.

- Asia Pacific is expected to grow rapidly in the upcoming years.

- By service type, the chat/messaging segment registered dominance in the market in 2024.

- By service type, the video calls segment is expected to grow at the fastest CAGR during 2025-2034.

- By animal type, the companion animals segment led the market in 2024.

- By animal type, the livestock segment is expected to be the fastest-growing in the studied years.

- By platform type, the mobile-based platforms segment held a major share of the market in 2024.

- By platform type, the web-based segment is expected to witness rapid expansion in the coming years.

- By payment mode type, the pay-per-consultation segment was dominant in the online vet consultation market in 2024.

- By payment mode type, the subscription segment is expected to grow rapidly during 2025-2034.

- By end user, the pet owners segment registered dominance in the market in 2024.

What is Online Vet Consultation?

Primarily, the online vet consultation market encompasses remote, digital appointments, which enable veterinarians to assess, advise on, and sometimes treat pet health concerns via video, chat, or voice, rising access for non-emergency, behavioral, & follow-up care. In this era, several veterinary clinics are shifting towards rigorous cloud-based systems for better access to records, which ensures easier virtual follow-ups & prescription management.

What are the Key Drivers in the Online Vet Consultation Market?

A significant driver is the expansion of pet humanization, and raised spending on preventive care, diagnostics, and specialty services. Alongside, pet owners are increasingly looking for versatile, remote, and on-demand veterinary care, especially for triaging concerns, which eliminates in-person clinic visits.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

What are the Substantial Trends in the Online Vet Consultation Market?

- In December 2025, Supertails strengthened its veterinary network with over 100 veterinarians as a part of its ecosystem across online consultations, at-home visits, and Supertails+ Clinics.

- In December 2025, Dial A Vet joined with Pawssum Mobile Vets to roll out the country’s first fully integrated online-to-in-home veterinary care pathway.

What is the Major Limitation in the Online Vet Consultation Market?

Numerous authorities need an in-person Veterinarian-Client-Patient Relationship (VCPR) before virtual care can be facilitated, which restricts diagnosis or prescribing medications remotely. Certain practices and pet owners are facing challenges in higher spending for maintenance, or the assessment of telehealth technology.

Regional Analysis

What Made North America Dominant in the Market in 2024?

North America captured the biggest revenue share of the market in 2024, due to the surging AI integration, regulatory advances, which enable remote prescriptions, & a crucial shift toward 24/7 on-demand care. Recently, Florida cleared the Providing Equity in Telehealth Services (PETS) Act to enable veterinarians to diagnose, treat, & prescribe medication via telemedicine without an in-person visit.

For instance,

- In September 2025, the University of Edinburgh’s Royal School of Veterinary Studies explored a video consultation service to support referral vets in treating gastroenterology cases.

In the U.S. online vet consultation market, rapid adoption of digital veterinary platforms is driven by high pet ownership, busy lifestyles, and strong telehealth infrastructure. Virtual consultations and AI diagnostics are becoming standard, supported by favorable regulations and integration with pet insurance and e-prescription services. This trend enhances access and convenience, creating future opportunities in preventive care and specialist teleconsulting services.

How did the Asia Pacific Expanded Notably in the Market in 2024?

Asia Pacific is estimated to witness rapid expansion in the online vet consultation market, as the region is prioritizing digital, on-demand consultation alternatives for non-emergency concerns, behavioral issues, & follow-up care. In the recent era, the Department of Animal Husbandry (DAHD) allied with UNDP to execute AI-powered systems for monitoring, vaccines, & disease control. Recently, JD Pet Hospital implemented "whole-lifecycle" management, which links online consultations directly with home delivery of medicines & offline referrals to their robust clinic networks.

In China’s online vet consultation market, growth is fueled by booming pet ownership, widespread smartphone use, and strong digital ecosystem integration. Platforms embedded in apps like WeChat enable easy access to remote consultations and health tracking. Government support for digital health initiatives and rising disposable income further expand the market, with future opportunities in rural access, AI tools, and telemonitoring for chronic conditions.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

Segmental Insights

By service type analysis

Which Service Type Led the Online Vet Consultation Market in 2024?

The chat/messaging segment held a major revenue share of the market in 2024. This is mainly driven by its ability to allow pet owners to share photos & videos of symptoms instantly, assisting in excellent remote diagnosis. This service is time-saving and eliminates the travelling. Also, it facilitates extensive access to nutritional advice, weight management tips, & routine care recommendations.

Moreover, the video calls segment is predicted to expand rapidly. The utilization of Scribenote and HappyDoc is widely leveraging AI to transcribe video consultations in real-time, automatically generating SOAP notes, i.e., Subjective, Objective, Assessment, and Plan. Alongside, smart collars, like PetPace 2.0, offer real-time, continuous critical sign monitoring, such as heart rate, respiration, and temperature, that directly caters for video consultations.

By animal type analysis

Which Animal Type Dominated the Online Vet Consultation Market in 2024?

In 2024, the companion animals segment was dominant in the market. Emerging online vet consultation solutions are providing immediate, 24/7 access to licensed veterinarians for video or chat consultations, & addresses non-emergency conditions, including skin problems, nutrition, and behaviour from home. An immersive platform like Dr.Pashu is significantly exploring 24/7 instant consultations for various pets in multiple languages. Laso, Vetic, and Chewy Connect with a Vet are offering on-demand video calls and live chats with veterinary technicians, respectively.

Whereas the livestock segment is predicted to register rapid growth. There are various services for this animal type, such as consultation for sudden issues, infections, or injuries. Alongside, these online platforms provide specialized guidance on breeding, pregnancy monitoring, heat detection, & calving/lambing assistance. Moreover, they explore advice on lowering mastitis, boosting milk yield, nutritional management, & deworming schedules.

By platform type analysis

Why did the Mobile-Based Platforms Segment Lead the Market in 2024?

The mobile-based platforms segment dominated with a dominant share of the market in 2024. These platforms are offering united AI-enabled diagnostic tools, like FirstVet's integration of AI to enhance remote health assessment accuracy & PetPace's smart collars for the analysis of biometric data for early pain detection. Whereas, novel "super apps" are syncing with smart collars and GPS trackers to facilitate vets with real-time vitals, such as heart rate and activity levels, during virtual visits.

Moreover, the web-based segment will expand fastest. These platforms are established from simple video-chat apps into comprehensive digital ecosystems, with a substantial effort into AI-assisted diagnostics & 24/7 on-demand access. Recently developed ezyVet revealed "AI-Assisted Notes," which employs generative AI to draft clinical SOAP notes from consultation transcriptions. Alongside, SignalPET unveiled "SignalSTAT," which combines AI with human oversight to offer radiographic interpretations within 45 minutes.

By payment mode type analysis

How did the Pay-Per-Consultation Segment Dominate the Market in 2024?

In 2024, the pay-per-consultation segment captured a major share of the online vet consultation market. Many clinics are highly providing "pay-per-ping" or flat-fee digital consults, i.e often $50–$80, that can be secured toward an in-person visit if a physical exam is needed. The widespread adoption of AI-powered platforms simplifies appointment booking and lowers administrative overhead for pay-per-visit clinics.

However, the subscription segment is anticipated to witness rapid expansion. Firms are extensively shifting towards proactive, digital-first management. Leaders, including Airvet, are facilitating subscription tiers, such as plans with unlimited 24/7 access to licensed veterinarians. Additionally, Fuzzy Pet Health & FirstVet unveiled AI tools to support screening symptoms & foster remote health assessments.

By end-user analysis

Which End User Led the Online Vet Consultation Market in 2024?

The pet owners segment was dominant in the market in 2024. Advanced solutions are exploring benefits to pet owners, such as pet owners convenient, 24/7 access to professional veterinary advice from home, also lowering travel stress for anxious pets & saving time. Pet owners are leveraging PetCube, which unites interactive hardware, like cameras and treat dispensers, with a veterinarian chat feature for real-time monitoring & consultation.

Collaborate with us for reliable market insights - https://www.towardshealthcare.com/schedule-meeting

What are the Recent Developments in the Online Vet Consultation Market?

- In July 2025, TelaVets launched its novel online veterinary platform, which offers cost-effective, convenient, and expert care for pets.

- In May 2025, TelmyVet & PetPace joined to unveil an innovative Quality-of-Life Consultation, a virtual care service to assist pets and their families during the most vulnerable stage of life.

Key Players List

- VetNOW

- Vetster

- Petriage

- TeleVet

- Vetsource

- Pawp

- VetClinic

- Pets Best

- WhiskerDocs

- Animalia

- Petco

- BabelBark

- Fuzzy

- Chewy

- Vets on Call

Browse More Insights of Towards Healthcare:

The global vet ultrasound system market was estimated at US$ 400 million in 2023 and is projected to grow to US$ 845.41 million by 2034, rising at a compound annual growth rate (CAGR) of 7.04% from 2024 to 2034. The demand for ultrasound systems is high due to the growing number of NGOs and animal shelters for animal care.

The global veterinarian care market size began at US$ 21.87 billion in 2024 and is forecast to rise to US$ 23.14 billion by 2025. By the end of 2034, it is expected to surpass US$ 38.3 billion, growing steadily at a CAGR of 5.75%.

The global veterinary hematology analyzers market size is calculated at US$ 1.01 in 2024, grew to US$ 1.07 billion in 2025, and is projected to reach around US$ 1.72 billion by 2034. The market is expanding at a CAGR of 5.44% between 2025 and 2034.

The veterinary vaccines market size is calculated at US$ 10.04 billion in 2025, grew to US$ 10.65 billion in 2026, and is projected to reach around US$ 18.11 billion by 2035. The market is expanding at a CAGR of 6.07% between 2026 and 2035.

The global veterinary biological product market size is calculated at US$ 17.9 billion in 2024, grew to US$ 18.58 billion in 2025, and is projected to reach around US$ 25.9 billion by 2034. The market is expanding at a CAGR of 3.78% between 2025 and 2034.

The veterinary oncology market size recorded US$ 1.58 billion in 2024, set to grow to US$ 1.77 billion in 2025 and projected to hit nearly US$ 4.86 billion by 2034, with a CAGR of 12.14% throughout the forecast timeline.

The global veterinary CRO and CDMO market size is calculated at USD 7.17 billion in 2024, grows to USD 7.77 billion in 2025, and is projected to reach around USD 16.13 billion by 2034.The market is expanding at a CAGR of 8.43% between 2025 and 2034.

The global veterinary surgical procedures market size was estimated at USD 51.74 billion in 2025 and is predicted to increase from USD 55.39 billion in 2026 to approximately USD 102.17 billion by 2035, expanding at a CAGR of 7.04% from 2026 to 2035.

The global veterinary infectious disease diagnostics market size is calculated at US$ 2.68 in 2024, grew to US$ 2.89 billion in 2025, and is projected to reach around US$ 5.76 billion by 2034. The market is expanding at a CAGR of 7.95% between 2025 and 2034.

The global veterinary rehabilitation services market size is calculated at USD 1.00 billion in 2024, grows to USD 1.12 billion in 2025, and is projected to reach around USD 3.01 billion by 2034. The market is expanding at a CAGR of 11.74% between 2025 and 2034.

Segments Covered in the Report

-

By Service Type

- Video Calls

- Voice Call

- Chat/Messaging

- Email/Pre-Recorded Messages

- Follow-Up Consultations

-

By Animal Type

- Companion animals

- Cats

- Dogs

- Others

- Livestock

- Cattle

- Poultry

- Others

- Exotic pets

- Birds

- Reptiles

- Others

- Equine

- Horse

- Others

- Aquatic animals

- Fish

- Amphibians

- Others

- Companion animals

-

By Platform Type

- Web-Based Platforms

- Mobile-Based Platforms

-

By Payment Mode

- Subscription-Based Services

- Pay Per Consultation Services

- Package/Bundle Services

- Insurance-Based Payment Models

- Free Consultations

-

By End User

- Pet Owners

- Veterinary Clinics

- Animal Shelter

- Animal Breeders

- Others

-

By Region

- North America

- U.S.

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

- North America

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/5624

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Towards Packaging | Towards Food and Beverages | Towards Chemical and Materials | Towards Dental | Towards EV Solutions | Healthcare Webwire

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.